New home sales in the US unexpectedly fell for a second month in June due to the mix of

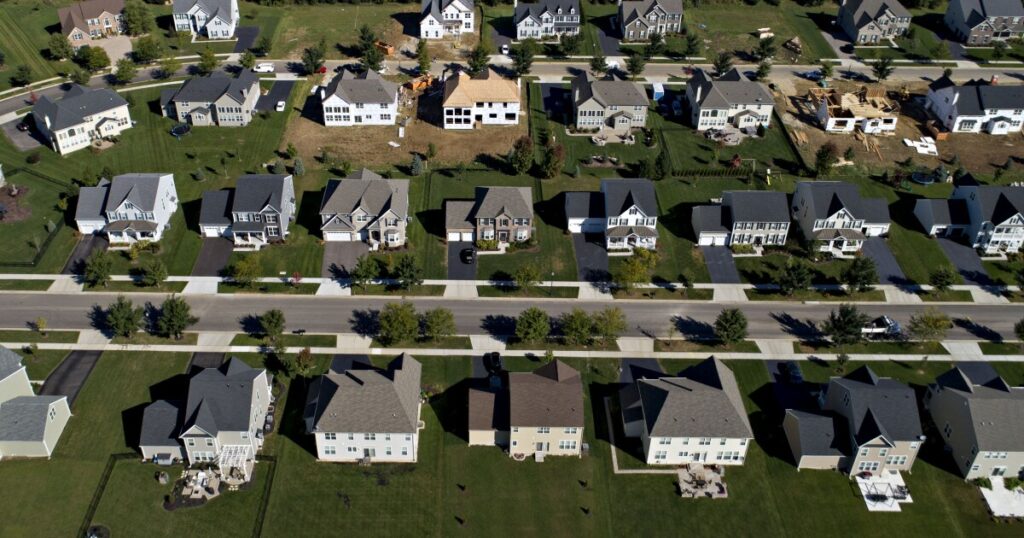

Contracts for new single-family homes fell 0.6% to 617,000 on an annual basis, the slowest since November, according to government data released Wednesday. The figure was compared with a median estimate of 640,000 in a Bloomberg survey of economists.

RELATED:

The latest figures follow a chaotic first half of the year, with sales gaining ground throughout the spring before falling the most in almost a year in May. Thirty-year mortgage rates have fallen below 7% in recent weeks but still remain double what they were at the end of 2021, prompting many builders to offer sales incentives such as buying out customers’ mortgages.

Meanwhile, builders have continued to expand supply, with inventory rising to 476,000 homes in June, still the highest since 2008. At current sales rates, that inventory would last 9.3 months, the longest since October 2022.

While builders would normally curtail production once the supply-to-sales ratio exceeds 7.5 months,

However, increased inventory has helped keep price growth in check. In June, the average sales price of a new home was little changed from a year ago at $417,300. After rapid growth in 2021 and 2022, price changes have been relatively moderate in recent months.

Despite some “jerkyness” in demand during the recently concluded third quarter, DR Horton Inc., one of the largest U.S. builders, reported a gross profit margin that exceeded analyst expectations. DR Horton has reduced the average home size by 2% over the past year in response to affordability challenges and is considering boosting townhouse construction in some markets, Chief Operating Officer Michael Murray said during an earnings call last week.

The government report showed that new home sales fell in the Midwest. Purchases fell to the lowest level in almost a decade in the Northeast, while rising slightly in the South and West.

While inventory on the resale market remains relatively low, builders are catching up. The number of completed new-build homes for sale rose to 102,000 in June, remaining at the highest level since 2009.

Sales of new homes are seen as a more timely measurement than purchases of previously owned homes, which are calculated when contracts close. However, the data is volatile. The government report found that 90% believed the change in new home sales ranged from a fall of 15.2% to an increase of 14%.