When interest rates fall, home buyers will re-enter the market in search of a new home. That data comes from

These potential buyers put a high priority on buying a home, with almost 70% reporting that buying a house is “crucial” or “very important” over the next 6 months.

Maxwell executives said the survey was created to “dig into their challenges, plans, and approaches to home buying as they look to enter the market over the next year.” Now, with conditions finally poised to improve, home ownership is becoming a real possibility for a significant, highly motivated segment of the American population, the company said.

Dealing with Home Buying Challenges

Interest rate challenges, historically low housing inventory, and economic volatility have made buying a home tough for many Americans over the past few years. Increasingly, would-be buyers have been excluded from the market due to unaffordability and lack of viable housing options.

Of those surveyed, more than half (54%) report searching for more than a year for a house to buy, with almost 18% saying they’ve been looking for over two years.

“Market conditions of the past five years have radically changed the home-buying process,” said John Paasonen, Maxwell Co-founder and CEO. “Instead of following straight-forward steps—finding a home, making an offer, and entering the lending process—these would-be buyers are meeting obstacles at every turn, effectively immobilizing a major segment of the market.”

Most commonly—and unsurprisingly—survey respondents cite high interest rates as a major obstacle preventing homeownership. Meanwhile, half of respondents say a lack of inventory keeps them from buying. Similarly, 47% report that homes they could afford don’t meet their criteria.

Financial qualifications also serve as an impediment to home-buying. Over 43% of sidelined home buyers say low credit score, high debt-to-income ratio, or lack of down payment funds keep them from qualifying for a loan, adding a further barrier to homeownership.

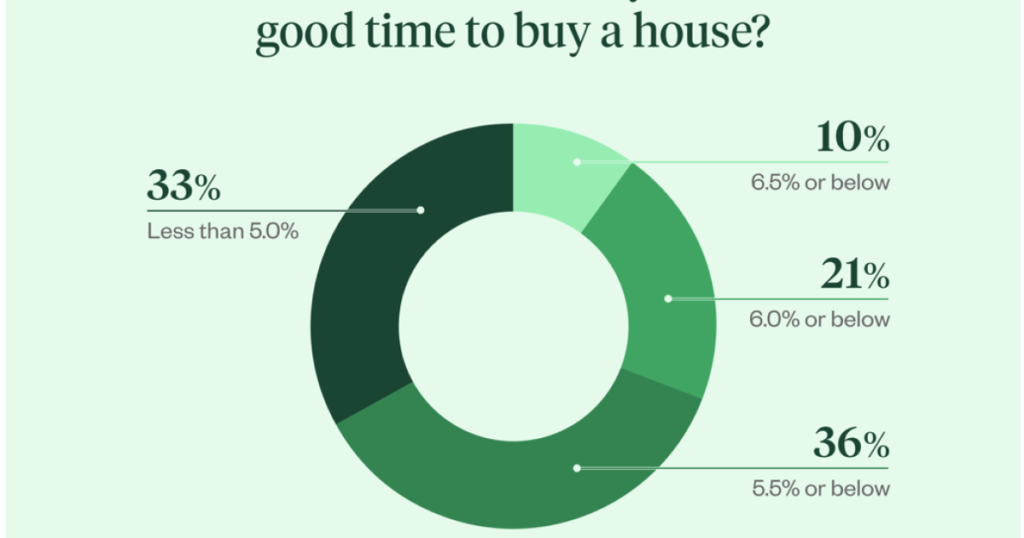

Despite the challenges, sidelined homeowners haven’t given up. Of those surveyed, the largest segment (36%) reported they’d look to buy at 5.5% or below. Another third (33%) say they’d wait for rates to fall to 5.0% or below—meaning around 70% of sidelined home buyers plan to take action once rates hit 5.0%.

Meanwhile, just 10% believe 6.5% represents an acceptable interest rate at which to buy.

“Today’s home buyers are sitting on the sidelines. They have had ample time to organize their finances, perform market research, and scour home listings,” Paasonen said. “This extended waiting period has created a unique type of demand driven by exceptionally strong motivation, high preparedness to act, and meaningful life pressures—like a new job or a growing baby. For lenders, this segment presents an immediately actionable opportunity once mortgage rates hit the tipping point.”

Many loan officers are already becoming aware of this opportunity. Almost two thirds (61%) of respondents have connected with a lender. Of that segment, more than half (53%) spoke with a national bank, 29% connected with a community bank or credit union, and 18% reached out to an online lender. About a third (34%) report wanting more information about down payment assistance or low-money down loan options.

While many surveyed have synced with a lending resource, nearly 40% still have not spoken with a mortgage professional—presenting plenty of opportunity for lenders to step up and support this segment, according to Maxwell.

As rate cuts materialize and inventory recovers, sidelined home buyers will begin to take action. Understanding, connecting with, and bending strategy to these buyers will be vital to lending success as conditions recover.

Maxwell surveyed sidelined home buyers who have been unsuccessfully looking to buy a home for 6 months or longer and are still aiming to buy over the next year. The survey took place in September of 2024 and contains responses from 18 to 44-year-old men and women residing across the United States. The results are in a new report entitled “