The Democratic mayor of Phoenix recently declared America’s housing crisis an “all hands on deck” challenge. Her counterpart in Columbus, Ohio, lamented the toll this is taking on “every rung of the socio-economic ladder.” The mayor of New York City stated bluntly, “We need to be in the business of building housing.”

Their words reflect a growing sense of urgency over the nation’s worst housing swamp in decades — and help explain how an issue often confined to local zoning hearings and city council meetings has thrust itself into the center of national politics.

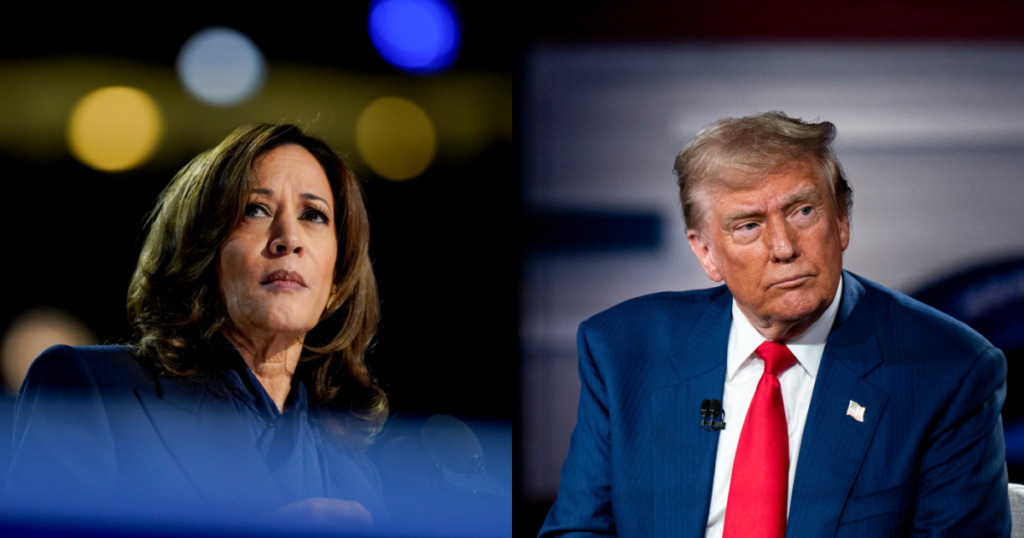

Democratic candidate Kamala Harris has made housing one of the few areas where she has made relatively detailed policy proposals, including tax breaks for builders who build starter homes and

GOP rival Donald Trump wants to open federal land for housing development and has promised to help with affordability by eliminating regulations.

These ideas are overtures to an electorate facing a stark reality: Homeownership affordability reached its lowest level in October since at least 2006, and is still hovering near that level, according to a

“We must prioritize housing as a national issue,” San Diego Mayor Todd Gloria said at an event at the Democratic National Convention in August. “We have responsibilities at the local level, but we need federal help to get this job done. Federal intent and investment can be a game changer.”

At stake over the next two months are the votes of frustrated homebuyers and renters in battleground states that could determine who reaches the White House and which party controls Congress.

In the longer term, without more supply, American cities face a potential loss of

Swing state impact

In swing states, including Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania and Wisconsin, the median is monthly

A

The Democratic party in particular seems to have responded to this focus. Harris was quick to mention her housing plan in her first response during Tuesday night’s debate with Trump.

Her campaign has hit the airwaves in Arizona and Nevada — which have been hit hard by rising housing costs, especially in swing states — with an ad touting her homebuilding agenda. A group called YIMBYs For Harris – a reference to opponents of the “not in my backyard” thinking –

The vice president has an advantage on this point that she and her allies can try to build on: Swing state voters said in the August poll that they trusted Harris over Trump to cover housing costs by a margin of 4 percentage points.

“I know what homeownership means and unfortunately it is out of reach for far too many American families right now,” Harris said in the new campaign ad. “We will end America’s housing shortage by building three million new homes and rental units.”

Harris’ plans also include “crack down on homeowners and Wall Street banks who raise rents and housing costs to drive down prices for our families,” Dan Kanninen, her campaign’s Battleground States director, said in a press release email sent statement. “But life will only get more expensive under Trump, with his Project 2025 agenda raising housing costs for millions of Americans while his wealthy friends benefit.”

Political obstacles

Still, it won’t be easy for Harris to score political points with her plan — nor to implement it if she wins the White House.

In the Bloomberg News/Morning Consult poll, her down payment aid plan was widely favored by Democrats who make up her base, but had less appeal among independent and undecided respondents. That suggests the plan is most powerful among voters already in Harris’ corner.

Trump will also highlight Harris’ plan during his campaign, arguing that she and President Joe Biden’s administration caused the housing affordability crisis.

The former president “has a real plan to beat inflation, lower mortgage rates and make home buying dramatically more affordable,” Karoline Leavitt, his campaign’s national press secretary, said in an emailed statement. She added that “illegal aliens” are driving up housing costs, but Trump will “cut taxes for American families, eliminate costly regulations, and free up suitable portions of federal land for housing.”

When it comes to Harris putting her proposals into practice, Mark Zandi, an economist who advised her campaign on the plan, said it would make sense if the down payment aid only came after an expansion of supply — otherwise it would simply increase demand can stimulate. and therefore push prices even higher. While a four-year timeline might be an ambitious timeline for building 3 million homes, Zandi said five to eight years is possible.

As for the likelihood that these proposals will pass Congress, Zandi said the strategy of focusing on private sector solutions, such as the builder tax credit, will have the advantage of appealing to lawmakers on both sides. sides of the aisle.

Of course, builders will need labor, materials and other resources, which are already strained by infrastructure and manufacturing projects. But with government tax breaks on the line, “that’s a big incentive to figure out the labor constraints and get it done,” said Zandi, chief economist at Moody’s Analytics.

Trump will face his own challenges on this issue. The federal areas at the heart of his plan are often far from urban areas with high employment opportunities. Moreover, the

Moreover, the candidate who wins the White House will still have to deal with the problem of a tangle of local regulations and zoning laws that are often shaped by an area’s political leanings, demographic shifts and socioeconomic makeup. These local rules play a key role in encouraging or suppressing housing take-up.

‘About steroids’

Multifamily builders have focused on market-rate housing, including much more expensive studios and one-bedrooms for affluent young singles. What is in short supply is affordable housing, with the National Low Income Housing Coalition estimating the United States

The roots of the current housing crisis – lamented by Phoenix Mayor Kate Gallego, Columbus Mayor Andy Ginther and New York Mayor Eric Adams, among others – emerged more than a decade ago. After the 2008 financial crisis, which was triggered by a housing bubble, construction projects slowed dramatically and workers fled the industry.

However, more recent circumstances have increased the tension and helped put the issue in the national spotlight. High interest rates in particular have convinced many homeowners to stay put, causing annual sales of existing homes to fall to the lowest level in almost 30 years in 2023.

The crisis has been “put on steroids and has become acute because of the pandemic, inflation, interest rates and all the things we know,” said Patrick Gaspard, president of the left-wing think tank Center for American Progress.